Ambition in Action: Diana Sandberg’s Dragon Fund Legacy

Walking into Associate Clinical Professor of Finance Diana Sandberg’s office is an unforgettable experience. I’m immediately greeted with a beaming smile, a not-so-whispered “hello” (she’s on the phone), and a hug that defies the formal expectations of academia. She’s the professor you’ll never forget — the one who lives up to the hype.

On a sweltering Tuesday in June, I met with Sandberg, who retired this summer after nearly 30 transformative years at Drexel, on the 11th floor of Drexel’s LeBow College of Business. And true to form, her greeting was as genuine and welcoming as ever.

For the past seven years, Sandberg has helmed the Dragon Fund, the student-run investment portfolio within Drexel’s endowment. Under her leadership, the fund has more than doubled in value, boasting a remarkable 122 percent return. It’s a level of outperformance that eclipses the notoriously challenging S&P 400 Mid Cap Index. For the finance folks, the Dragon Fund achieves a higher annualized return and exhibits lower volatility compared to the Russell Mid Cap Index and the S&P 400 Mid Cap Index. So, it’s no surprise that the Dragon Fund is recognized as the endowment’s best-performing manager. Full stop.

So, what makes the Dragon Fund special? “Well, it’s not me,” Sandberg says in a way that only she could. “It’s them — the students pick the stocks, do the analysis, pitch it, debate on it and vote.” The students are in the driver’s seat. They decide by majority vote which stocks are new additions, which are trimmed, exited or added to. Trades happen three times a year, so students cannot be market-timers. These are long positions, and there are over 100 of them. “I push them to think broadly and across sectors.” As far as experiential learning goes, the Dragon Fund is one of the best examples.

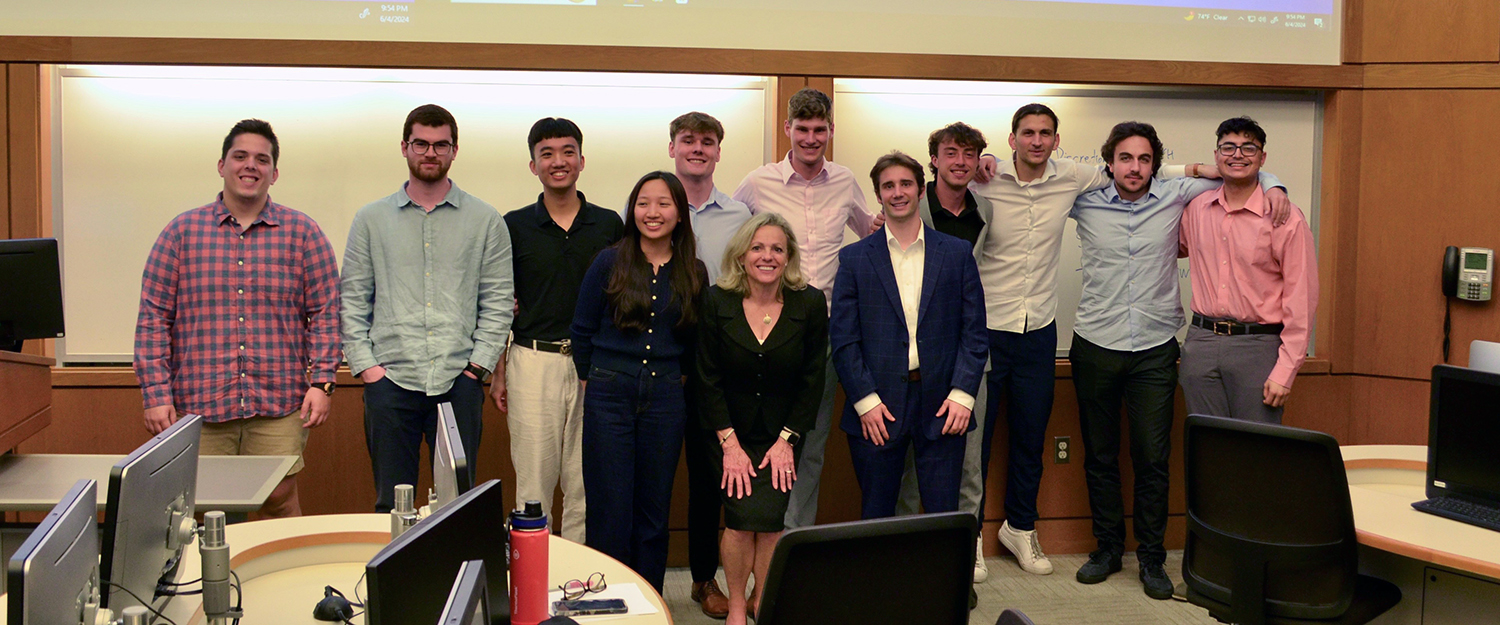

Having sat in on a recent Dragon Fund class, I can attest that it is not your traditional lecture. Nearly 80 percent of the class is discussion-based, starting with recent market movements, economic data and earnings releases, followed by a deep dive into valuation models, financial statements and the like. These were not just students in a class; they were portfolio managers.

That’s the ethos of the Dragon Fund. In Sandberg’s class, Drexel students become analysts. She wants them to think of her as their supervisor. She helps them grasp new concepts and hones their craft, but they have to figure it out.

The Sandberg Effect

Sandberg’s path to finance was anything but conventional. Starting out as an electrical engineer with over $100 million in projects under her responsibility, she eventually transitioned into finance. But it was her sharp analytical mind and passion for problem-solving that truly shaped her role as a finance professor. In addition, Sandberg is a licensed private pilot — a skill that requires dedication, lifelong learning, precision, flexibility and a passion for understanding how things work. “In both engineering and flying, you have to think on your feet, and you can’t afford to be wrong,” she says. “I bring that same mentality to the Dragon Fund and all of my classes.”

Her unique background has given her a different lens through which to teach finance. Sandberg doesn’t just teach students how to pick stocks; she teaches them how to think about finance as a web of interconnected decisions. “You have to take in all the noise around you and ask, ‘What’s relevant?’” she explains, often reminding students that finance is about understanding how markets react to a wide range of factors, from inflation to geopolitical shifts and elections on the other side of the globe. As one student recalled, “She would dive into global events — whether it was U.K. inflation or a political shake-up in the Eurozone — and challenge us to see how it would impact the U.S. market.”

It’s this relentless drive to push her students beyond textbook knowledge that defines Sandberg’s teaching style. “I don’t teach from slides,” she admits. “It’s all in my head because it’s a story — and that story changes all the time.” Sandberg is known for walking into class with a narrative in mind, bringing in real-world examples, and drawing connections between past and present. She’s not one to stick to the script. Whether she’s breaking down financial statements or challenging her students with thought-provoking questions, Sandberg’s goal is to make them see the bigger picture.

One thing is clear in Sandberg’s classroom: you must be engaged, and you must do the work. In an era where students are often glued to their screens, Sandberg goes the extra mile to keep everyone focused. “I’ve been known to confiscate a phone or two,” she admits with a laugh. She can also tell if you’ve used AI or ChatGPT to do your work. “I have eyes in the back of my head,” she jokes. Sandberg’s classroom presence is a mix of warmth and discipline. In one breath, she’ll recall her skill at tossing chalk to get attention, and in the next, she’ll mention she’s a hugger.

These lighthearted but firm interventions show Sandberg’s no-nonsense approach. Her goal is simple: full engagement. “I need you to be present, to focus. This is real-world stuff,” she says. These moments have become part of the class lore, passed down among students, reflecting both the high expectations she sets and the genuine affection they have for her. They’re small but memorable examples of Sandberg’s relentless efforts to keep her students grounded in the material, blending theory with real-world application and preparing them for the job market.

Sandberg’s approach has consistently put Dragon Fund students on par with Ivy League counterparts, often leading to even better outcomes. “I’ve always elevated them,” she says, “anyone would be lucky to hire them.” And hire them they do — her students have landed roles at top-tier firms like Goldman Sachs, J.P. Morgan, UBS and Chase, among others. Sandberg is their biggest advocate, always ready to take a call or write a recommendation, no matter the time or day. Her mentorship and tireless support have helped open doors that are typically reserved for graduates of the most prestigious schools, with Dragon Fund students regularly coming out ahead in the competition for elite positions.

Heart of the Dragon (Fund)

To Sandberg, the Dragon Fund is not just a class — it’s a living, breathing entity that embodies her love for teaching and mentorship. “It’s everything I love about teaching,” she says. “The students take ownership, and that kind of responsibility is something you can’t teach in a textbook.” Over the years, she has watched her students thrive under the weight of that responsibility. From selecting and analyzing stocks to making real investment decisions, the Dragon Fund is where theory meets reality.

For Sandberg, the most rewarding part of the Dragon Fund isn’t reaching financial milestones — though surpassing $5 million in market valuation this summer is certainly a point of pride — it’s seeing her students develop into confident, skilled analysts and professionals. “I trust them with real money — up to $100,000 worth of decisions. I push them, but they have to figure it out on their own. That’s what prepares them for their careers.”

Her connection to the students runs deep. Sandberg treats them as more than just learners; they become part of her extended family. She’s the type of professor who checks in on her former students years after they’ve graduated. “One of my Dragon Fund students went through a really tough time,” she shares. “We met every week for two years, and now he’s thriving as a trader in New York.” It’s one of many examples that students point to when describing Sandberg’s lasting mentorship.

And remember how Sandberg would sometimes confiscate phones? It is those students, and many more, that have stayed in touch with her long after graduation. One such student, Michael Castagna ‘23 — who didn’t have his phone taken away — took a sacred vacation day from his job at Barclays and traveled from New York in June to attend her final Dragon Fund class. He says that Sandberg and the Dragon Fund were the most impactful parts of his Drexel experience. Michael wouldn’t miss her sendoff, joining her for one last round of stock pitches.

The Power of Real-World Learning

The Dragon Fund is no ordinary class. It’s a job — a real-world training ground where students make $5 million worth of decisions. Sandberg always tells them, “I give you the bricks and mortar. Now, you build the house.” It’s not her baby; it’s theirs. From stock selection to portfolio management, every decision lies in the students’ hands. The stakes are real, and so is the responsibility. This level of hands-on experience is what sets the Dragon Fund apart from typical academic courses. Students leave not just with knowledge, but with the confidence that comes from making real investment decisions that impact Drexel’s endowment.

Sandberg is relentless in ensuring her students are prepared for the industry. Whether it’s improving their presentation skills after hearing feedback from employers or negotiating Wall Street Prep courses at a discounted rate, she equips her students with the tools they need to succeed. “You can’t be a pilot and not know how an airplane works,” she says, echoing her background in aviation. Similarly, she believes finance professionals must understand the mechanics of the industry. That’s why her students master Excel, analyze options data on Bloomberg, learn MIT-style p-sets and navigate FactSet with ease. Sandberg leaves no stone unturned when it comes to preparing her students for the real world.

It’s not just about the $5 million or the fund’s outperformance — though as someone who knows Sandberg, she does care about beating the S&P 400 Mid Cap. For her, the biggest reward is the students. “I will miss the relationships,” she admits, “the heated debates about stocks like Lululemon, pulling over on the side of the road to write recommendation letters and convincing Deutsche Bank managing directors to take a chance on a Drexel student.” Her office has always been a safe space, where students could come for support, guidance and the occasional pep talk. Having her number on speed dial means having a lifelong advocate who will move mountains to help you succeed.

Sandberg teaches with the rigor of Ivy League institutions but with the heart and tenacity that are uniquely her own. She’s helped put Drexel students on the map, opening the doors at countless firms. Through her passion for experiential learning, she has shown that Drexel students aren’t just competing with Ivy League grads — they’re beating them. This success is a testament not only to the students’ hard work but also to professors like Sandberg, who push them to reach their full potential.

As she steps away from the Dragon Fund, her legacy will be felt in every future analyst, trader and portfolio manager she’s helped shape. And while Sandberg may be retiring and handing over the reins to another much-loved professor, Maneesh Chhabria, PhD, assistant clinical professor of Finance, the fund — a permanent part of Drexel’s Endowment — will continue to prove that ambition doesn’t wait, just like Drexel students, who keep showing Wall Street the Drexel difference.

This article was written by Stephen Chase, a 2022 Drexel MBA graduate and investment analyst with Drexel University’s Endowment Investment Office.