Closing the Revolving Door

At the Gupta Governance Institute 16th Annual Corporate Governance Conference held on April 14 2023, Joseph Kalmenovitz, Assistant Professor of Finance at the University of Rochester, showed that regulators protect their outside option for a higher-paid job in the private sector by avoiding post-employment restrictions and by being more lenient towards regulated companies.

Key insights

- Regulators can leave their government position to work for a regulated firm in a switch that is often referred to as “the revolving door”. However, post-employment restrictions limit the flexibility of higher-ranking and higher-paid government employees to swap employers. The revolving door incentive encourages employees of regulatory agencies to protect their outside option by staying below the cut-off salary that triggers post-employment restrictions. The latter is achieved through fewer promotions and slower salary progression.

- The revolving door incentive affects 1.2 million employees across 13 federal agencies. In these agencies, on average, 32% of employees sacrifice 5% of their wage potential to preserve their outside option. These revolving agencies regulate sectors whose average pay is 14% higher than the sectors regulated by unaffected agencies. They also enjoy greater autonomy to exercise their powers and are largely insulated from the supervision of elected officials.

- Revolving agencies show more regulatory leniency compared to other agencies. They impose 51% fewer regulations and those regulation are less burdensome: they require 51 million fewer forms, 2 million fewer hours, and $85 million fewer expenses to their regulated companies. Eliminating all post-employment restrictions would increase leniency by almost 3% and reduce compliance costs by an estimated 340 million dollars a year.

Summary of Complete Findings

Workforce incentives are an important component of governance in U.S. firms because they can have tremendous impact on their performance. This study shows that post-employment restrictions in regulatory agencies can also create powerful incentives for government employees, affecting regulatory activities and, ultimately, changing the burden of compliance for regulated companies.

The flow of government employees to jobs in the private sector is often called the revolving door. Employees of regulatory agencies have the opportunity to be employed in the industries they regulate, where salaries are usually higher. However, senior government employees are barred for one year from communicating on matters that pertain to their former agency, and from representing or advising foreign entities. Violations are subject to criminal and civil fines, and up to five years in prison. These post-employment restrictions are triggered by a salary threshold.

The researchers analyze an astonishing dataset of 23 million employee/year observations across 260 federal agencies between 2004 and 2021. They assess the interplay between the revolving door incentive and the post-employment restrictions, revealing how employees respond to it and the impact of their response.

They first find a sharp split between two groups of federal agencies: revolving agencies are those that exhibit a large response of their employees to the outside option incentive; indifferent agencies are those without any significant impact from the incentive. The revolving group includes 1.2 million employees across 13 federal agencies. The majority of financial agencies belong to this group, including the Commodity Futures Trading Commission, Office of Comptroller of Currency, Federal Deposit Insurance Corporation, and the Securities and Exchange Commission. The indifference group is the largest, with 21.5 million employees across 115 agencies. This group includes large cabinet departments such as Veteran Affairs, Transportation, and Labor.

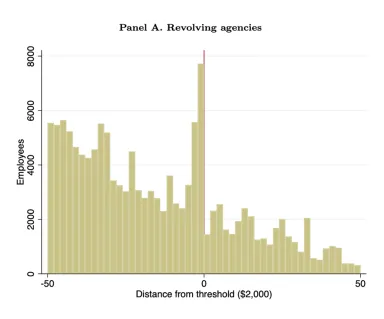

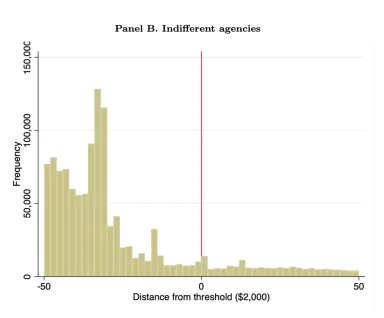

Panel A and Panel B illustrate the striking difference between these two groups of agencies. In revolving agencies, employees “bunch” just below the salary threshold that triggers the restrictions to work for a private sector company. Within the +/- $5000 range, the number of employees to the left of the threshold is 263% higher than the number of employees to the right. This bunching around the threshold is not present in indifferent agencies.

In revolving agencies, the marginal employee is willing to give up $4,000 in annual salary, to avoid triggering the post-employment restrictions. Nearly one-third of the average revolving agency employees are willing to sacrifice part of their salary and, therefore, they are actively considering private sector jobs. Financial regulatory agencies have a wider bunching range relative to other agencies. At the Commodity Futures Trading Commission, for instance, 23.5% of employees respond to the revolving door incentive. They accept a $7, 000 pay cut in order to stay below the threshold, which equals to 5% of the average salary.

Employees just below the salary threshold are also found to be 1 – 1.6 percentage points more likely to leave their agency within the next two years relative to those further below the threshold. Consistent with the observed bunching behavior, promotion rates close to the salary threshold are 5.8 − 5.9 percentage points lower and pay growth slows down by 3.7 − 3.8 percentage point as the employee approaches the threshold. The latter findings suggest that passing on promotion and slow salary progressions are the mechanisms that allow strategic bunching.

The study further compares the characteristics of revolving agencies and indifferent agencies. It finds that revolving agencies enjoy substantially greater autonomy in the exercise of their powers, they interact with the public more frequently, and the sectors they regulate have significantly higher average pay. More significantly, revolving agencies impose lower regulatory burdens on companies. A typical revolving agency imposes 51% fewer regulations and those regulations are less burdensome: they require 51 million fewer paperwork forms, 2 million fewer hours, and $85 million fewer expenses. Additionally, revolving agencies are 24.5% less likely to make any progress in their rulemaking activity. They have 5.1 fewer rules on their docket (compared to 7.2 rules for the average agency). In sum, revolving agencies are associated with significantly lower regulatory burden. This provides evidence that outside option incentives lead to regulatory leniency, because government employees in revolving agencies are interested in maintaining good relationships with regulated companies to improve their chance of landing a job.

Finally, the researchers investigate the impact of amending the post-employment restrictions for federal employees. They find that tightening the restrictions would discourage regulators from showing leniency towards regulated companies. More specifically, doubling restrictions would reduce leniency by 2%, which translates to about 240 million dollars in higher compliance costs annually. The tightening would have minimal impact on the labor supply to the public sector with only an estimated 0.14% reduction. Conversely, removing all post-employment restrictions would increase leniency by almost 3% and reduce the costs of compliance by about 340 million dollars a year. The labor supply to the public sector would, again, experience minimal changes with an increase of just 0.07%.

In conclusion, this innovative research shows that work incentives for government employees can have a large impact on the activities of regulatory agencies and, as a result, on the compliance burden faced by regulated companies.

“Closing the Revolving Door” by Joseph Kalmenovitz (University of Rochester), Siddharth Vij (University of Georgia), Kairong Xiao (Columbia University).